An Introduction

In the 1970’s an American engineer called JM Hurst published a theory about why financial markets move in the way they do. The theory was the result of many years of research on powerful mainframe computers, and it became known as Hurst’s Cyclic Theory. Hurst claimed a 90% success rate trading on the basis of his theory, and yet the theory has remained largely undiscovered and often misunderstood.

An almost-forgotten theory

Hurst published two seminal works: a book called The Profit Magic of Stock Transaction Timing, followed a few years later by a workshop-style course which was called the Cyclitec Cycles Course(now unfortunately out of print, but published until 2012 as JM Hurst’s Cycles Course).

There are several very enthusiastic advocates, prominent traders and writers who proclaim Hurst as the “father of cyclic analysis” and confirm the efficacy of the theory (including the late Brian Millard who wrote several books about Hurst’s theory), but why is it that the theory isn’t better known and more widely used by technical analysts? There are, in my opinion, two reasons:

- Firstly, Hurst’s Cyclic Theory is not “easy”. While it is beautifully simple and elegant in its essence, it is not a simple theory to understand or to apply. The Cycles Course is over 1,500 pages long, and most people take several months to work through it.

- Secondly, although the theory presented in both the Profit Magic book and the Cycles Course is the same, there is a vitally important distinction between the analysis processes presented in the two. Hurst claimed his success based on the process presented in the Cycles Course, whereas many people read the Profit Magic book and go no further, with the consequence that they never discover the more effective process presented in the Cycles Course.

Hurst’s Cyclic Theory in a nutshell

Hurst defined eight principles which like the axioms of a mathematical theory provide the definition of his cyclic theory. The principles are:

- The Principle of Commonality

All equity (or forex or commodity) price movements have many elements in common (in other words similar classes of tradable instruments have price movements with much in common).

- The Principle of Cyclicality

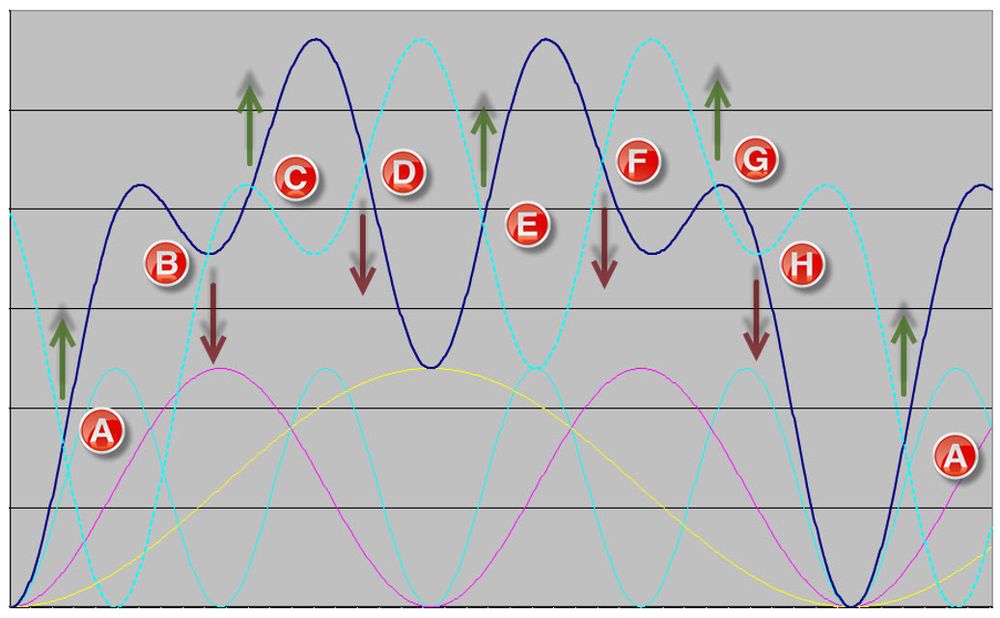

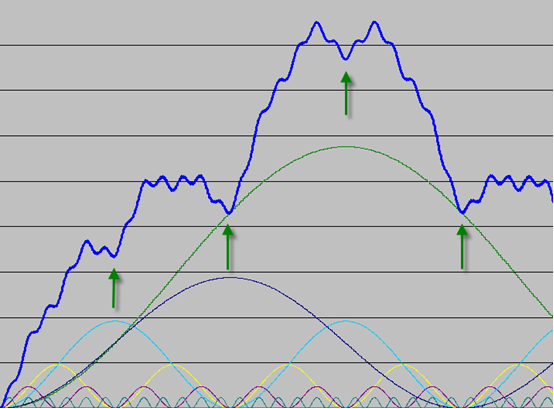

Price movements consist of a combination of specific waves and therefore exhibit cyclic characteristics.

- The Principle of Summation

Price waves which combine to produce the price movement do so by a process of simple addition.

- The Principle of Harmonicity

The wavelengths of neighbouring waves in the collection of cycles contributing to price movement are related by a small integer value.

- The Principle of Synchronicity

Waves in price movement are phased so as to cause simultaneous troughs wherever possible.

- The Principle of Proportionality

Waves in price movement have an amplitude that is proportional to their wavelength.

- The Principle of Nominality

A specific, nominal collection of harmonically related waves is common to all price movements.

- The Principle of Variation

The previous four principles represent strong tendencies, from which variation is to be expected.

In essence these principles define a theory which describes the movement of a financial market as the combination of an infinite number of “cycles”. These cycles are all harmonically related to one another (their wavelengths are related by small integer values) and their troughs are synchronised where possible, as opposed to their peaks. The principles define exactly how cycles combine to produce a resultant price movement (with an allowance for some randomness and fundamental interaction).

These simple rules distinguish Hurst’s theory from any other cyclic theory. For instance most cyclic theories consider cycles in isolation from each other, and cycles are often seem to “disappear”. By contrast cycles never disappear according to Hurst’s theory, but they may be less apparent because of the way in which cycles combine. It is the fact that Hurst’s theory stipulates that there are an infinite number of cycles that makes it particularly different, and also begins to explain why it is impossible to forecast price movement with 100% accuracy. Just as it is impossible to conceive of the sum of two infinite numbers, it is impossible to define the result of combining an infinite number of cycles.