Macro Outlook: UPDATE Oil (WTI) - 28 March 2023

Assessing the recent strength: still see as head fake rally due to fail soon.

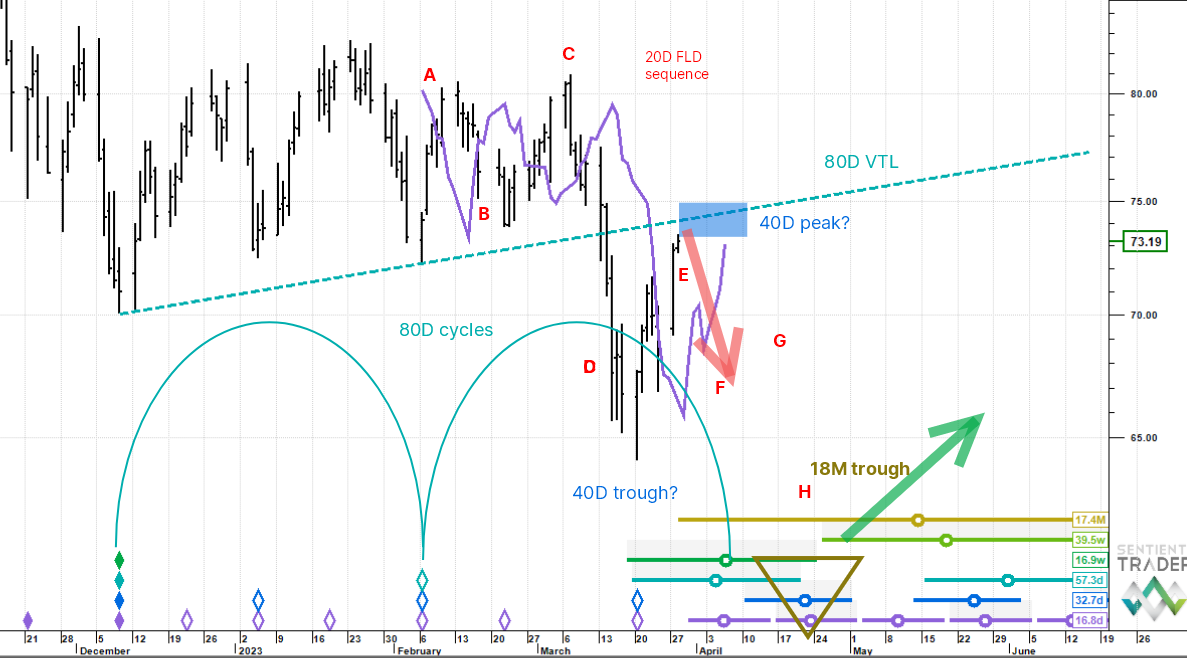

- The working hypothesis is that Oil just bounced out of a 40 day cycle trough, rather than the big 18 month cycle trough pointed to in the last few notes. A 40 day cycle upswing obviously is much less impactful than an 18 month cycle upswing. In short, we believe that the real bottom lies ahead of us, likely in late April / early May.

- Price has just passed up through the 20 day FLD which projects to just under 75, which is also where the 80 day VTL (valid trend-line) sits. This line broke down a few weeks ago and is a natural magnet for a return trip. It should also serve as resistance and we think a top out here will be an early (left translated 40 day cycle peak). The next 40 day cycle trough should coincide with the major trough in the 18 month cycle nest of lows. So the call is DOWN.

- You will notice that I have labelled the chart with red letters A to H. I don't want to go into this in too much detail here, but it is an FLD trading sequence strategy we use to track the interactions of a 20 day FLD and price in an 80 day cycle.

- The 80 day cycle bottomed in the first week of February and the standard sequence interactions are as follows: A up through the FLD; B pull back to FLD at 20 day cycle low; C up (typically the strongest push but not here - bearish undertones); D down through the FLD again (typically muted, but here a power move - bearish undertones again); E up through the FLD and this is where we are now. So we are looking for a strong F down, a weak G up and a finishing H down.

- Note: not shown is a 40 day FLD which would be crossed up around 76. If this happens we may have to consider a rethink.